Resources ... Let Us Know How Can Help

If you plan to purchase your first or tenth home, start here. Buying property in Massachusetts is not difficult, but it's helpful to understand and be aware of the local customs before you start your search. Our goal is to help guide you toward the best decision for your unique situation. To do this, we believe that a well-informed client will ultimately be the most satisfied, too. We look forward to discussing the current market conditions and trends with you - most important, we can't wait to help you discover your dream home!

Check out our on demand home buyer video seminar here! After registering, you'll have instant access to our on demand buyer consultation and we'll immediately mail (USPS) your home Massachusetts Home Buyer Booklet. It include everything you need to buy a home in Massachusetts - even sample forms. Click here to get access now!

Selling your home is a big decision. It's not just about moving, it's about identifying a proven seamless process that will help maximize the value of current property within a timeline that meets your specific needs.

There's no doubt that this can be a stressful process, but after successfully selling 100s of homes, we've identified the smoothest processes, most effective marketing strategies and negotiation techniques to ensure the highest sale price with the least amount of hassle. Contact us today for a no obligation consultation.

Senior Options

Connect with experts to discuss senior living options. Knowing where to begin is the hardest part, so we've included a few helpful resources below:

Home Hazards

Asbestos - Asbestos.com provides a Guide to Asbestos in The Home ... it outlines common asbestos locations, related heath concerns and how to deal with asbestos when it's found. Tips on how to hire an asbestos remover can also be found at asbestos.com.

Lead Paint - Slowly phased out in the 1960s and 1970s, lead paint was ultimately outlawed in residential use in 1978. Consequently, all homes older than 1978 are suspect; however, there are many ways to mitigate lead paint and costs can vary. In recent years, the government has eased mitigation requirements to encourage lead compliance. The below sites provide additional information about lead paint safety ... you can even search property to see if it's been tested for lead paint.

Mass.gov - Search property testing history

Massachusetts Childhood Lead Poisoning Prevention Program’s Lead Safe Homes 1.0 database

New England Lead Prevention - Information for home buyers, tenants, landlords, etc.

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn't own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn't show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time – and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

Homeowners deciding to sell their houses (existing homes)

New home construction (newly built homes)

Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

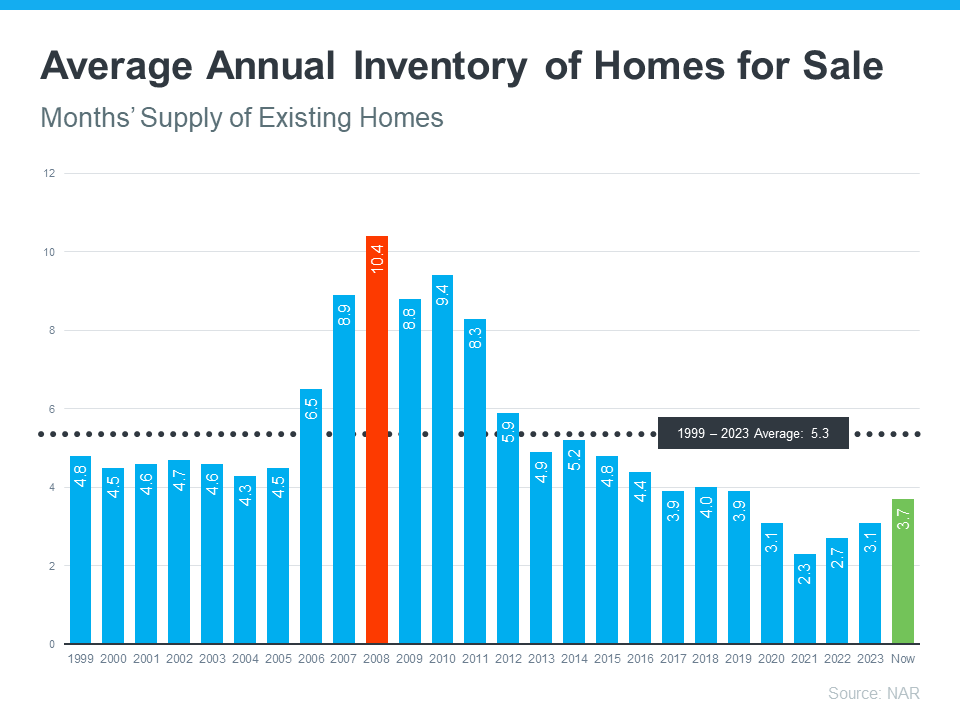

Homeowners Deciding To Sell Their Houses

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not the case right now.

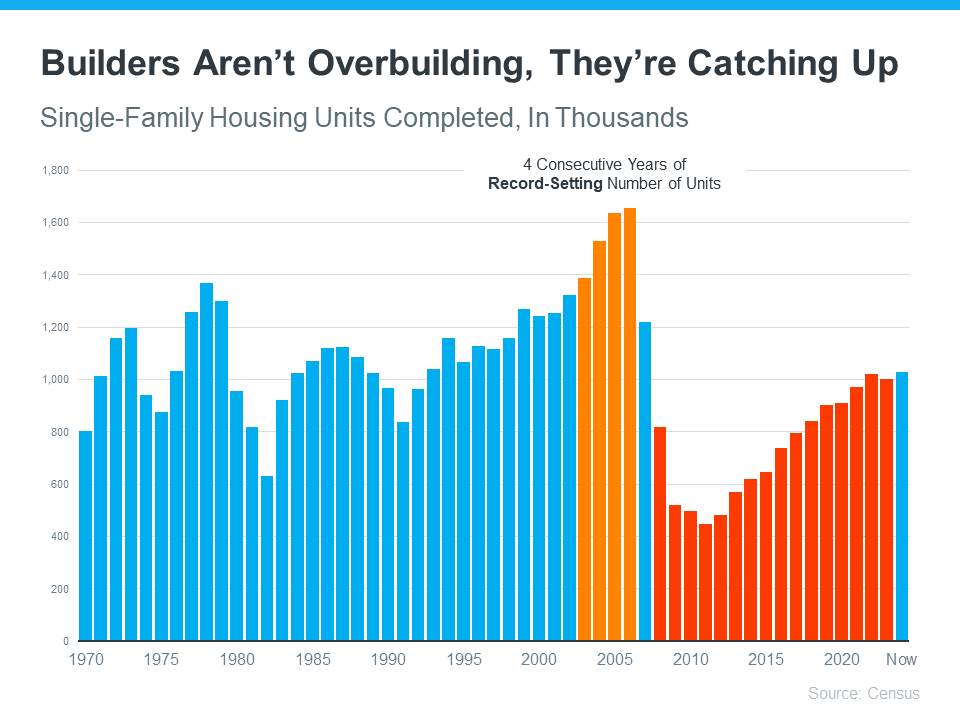

New Home Construction

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“What’s more, builders remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale.”

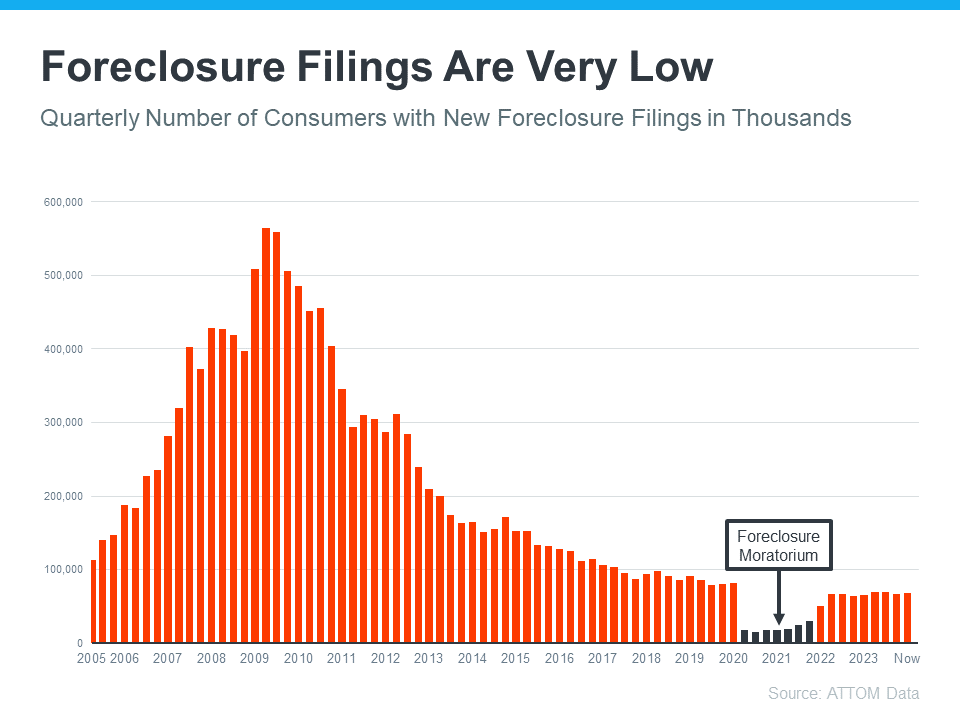

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up – remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably high home prices due to waning demand—remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren't headed for a crash:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon.

Other Useful Tools

Financing ... everyone's budget and cash flow is different. Whether you you get paid on a salary, hourly, bonus or commission basis, understanding your monthly obligation is critical when buying a home.

Here is a link to a mortgage calculator to help you start your planning.

Explore A Career in Real Estate!

Real estate can be a very rewarding career ... each day we have the opportunity to meet and help new people! Being able to help someone start a new stage of life is an extremely gratifying experience.

It's relatively easy to get started, but knowing where and how to start is the biggest challenge. Unfortunately, the state licensing exam doesn't cover any marketing or business planning ... so new agents are often left to sink or swim! In 2023, the National Association of Realtors estimates 10,000 agents are being forced to leave the business each month!

After being in business for 20+ years, I've been able to help many buyers, sellers AND agents succeed. Getting started the right way with the right company can make or break an new agent. eXp Realty is now selling more homes than any other brokerage, so we have tools and training to help you succeed. Moreover, it would be my pleasure to introduce you to the company's tools, answer any questions that you have about the business and share my systems and training so that you are able to quickly launch your new business. Let's connect!